Hawaii has 12 brackets, the most in the country.

Conversely, 32 states and the District of Columbia levy graduated-rate income taxes, with the number of brackets varying widely by state. For both individuals and corporations, taxable income differs from-and is less than-gross income.

Of those states taxing wages, nine have single-rate tax structures, with one rate applying to all taxable income Taxable income is the amount of income subject to tax, after deductions and exemptions. Seven states levy no individual income tax at all. Forty-one tax wage and salary income, while New Hampshire exclusively taxes dividend and interest income and Washington taxes the capitals gains income of high earners. Forty-three states levy individual income taxes. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S.Įs are a major source of state government revenue, accounting for 36 percent of state tax A tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.Ĭollections in fiscal year 2020, the latest year for which data are available. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment.

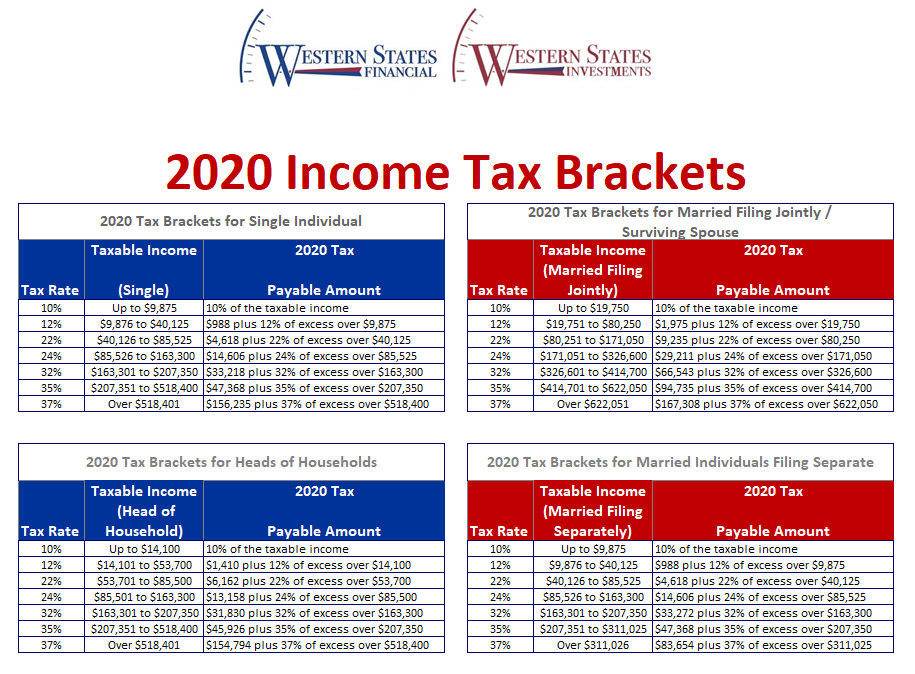

imposes a progressive income tax where rates increase with income. Individual income tax An individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns.

0 kommentar(er)

0 kommentar(er)